Out of Hock

Cold Minnesota

March 28, 2024

Had to get my shovel out of hock this week along with my skates and my hockey stick.

One whole aisle at the pawnbroker has hockey sticks and hockey pucks.

The next aisle is all the gear to protect someone from the stuff

in the previous aisle. The aisle after that seems to have all the

skates in the state. Hockey is the reason why things go into hock, but

not why I was getting my shovel back.

On March 24th, it snowed 8.2" at the airport, but not just at the

airport, so I needed my shovel. Then it snowed about four more inches

on March 26th, and I shoveled again. Trace amounts yesterday caused me

to trace a shovel in the snow.

Two weeks ago I bemoaned like I've never bemoaned about hot Minnesota.

I really don't bemoan. Yet, there was one time I complained to a woman

in Alabama about hot Minnesota. “Minnesota?!?” she asked, ticked off. And that's just it -- the ticks.

When the winters aren't cold enough to kill the ticks nestled snuggly

in moose and elk armpits, the ticks take over. The woods. The fields.

The malls. Transit. The ticks are everywhere. Hide your dogs. Find your

cats to hide them too. That's not the cat; that's a furball. Cats hock

up furballs as decoy defenses against ticks.

You might be thinking, “Huh?” I don't have a huh-reply. You may also wonder, why not keep the shovel out of hock and use it against the ticks.

Shovels are not the greatest weapon against ticks. Ticks are harder

than most shovels and most snow plows. They are survivors with

incredible vision.

Music Association: Survivor - Eye of the Tiger

Ashes to Ashes

Hot Minnesota

March 14, 2024

Minnesota is hardly Minnesota.

This was the winter that wasn't. The average temperature for the past

three months (December, January, and February) was 29.9 degrees. That's

an average of barely freezing. The Twin Cities set no record lows and

14 record highs, with 18 days hitting 50 degrees.

This winter was also the second least snowiest winter with only 14.3 inches of snow, which often disappeared soon after it fell.

Climate change and El Niño combined to deprive Minnesota of winter.

The problem that bugs us are going to be the bugs. The emerald ash

borer continues its invasion and has arrived on the doorstep of the

Chippewa National Forest, the largest expanse of black ash trees in

North America. A billion black ash trees stretch across 1.2 million

acres in north central Minnesota. These trees are uniquely

adapted to grow in wetlands, acting like giant straws slurping water

out of the soil. Without the black ash trees, the wetlands will be

wetter. The tadpoles that dine on rotting ash leaves will be stuck

eating leaves with higher amounts of tannins (yuck!). The loss of the

black ash trees will be devastating to a large ecosystem.

Black ash wood is important culturally to many Anishinaabeg bands

across northern Minnesota, in part to make baskets and lacrosse sticks.

Music Associations: Stereophonics - A Thousand Trees

and The Beatles - Norwegian

Wood

Pardoning Partner

Trump Picks Trump

January 22, 2024

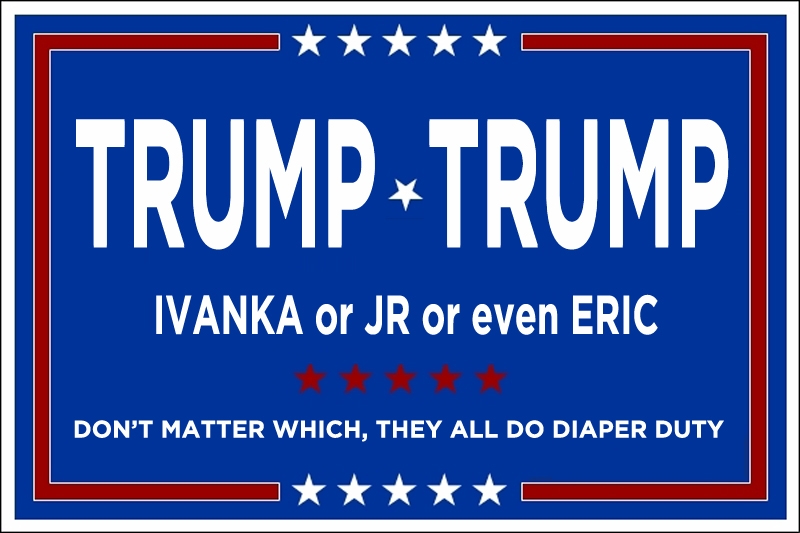

Who will Trump pick as a Vice President?

When unquestioning loyalty matters more than laws or ethics or skills, only one name could qualify as Trump's vice president.

That name is Trump. It really doesn't matter which Trump Trump will pick, does it?

Trump will pick Trump as his pardoning partner. Everyone else has let him down. They had opinions. Mice squeak.

Ivanka Trump or Donald Trump Jr or even Eric Trump could let Trump be

Trump without worrying about the country or the stock market or climate

change or lives or women's rights or anyone on the long list of people

and types of people Trump hates. The Trumps all know how to smile

despite the stench.

And if that time came to assume the responsibilities of president, any

of the shadow Trumps would stand by their brand and keep it out of jail.

Music Association: America - Horse With No Name

Accountability

$500,000 Reward & Court Cases

Accountability

$500,000 Reward & Court Cases

January 6, 2024

It's been three years since former president Trump launched his insurrection at the U.S. Capitol. Three years since rallying a violent mob from behind

bullet proof glass and then throwing a plate of ketchup at the White

House dining room wall. Also, the FBI wants your help finding the January 5th bomber and has upped the reward to $500,000.

Trump's court schedule

has just been updated due to his push for the U.S. Supreme Court to

hear the Colorado ballot case. Trump loves the courts and the delays.

Trump's 2024 court cases schedule, subject to change:

January 11 - The New York state financial fraud case closing arguments

January 16 - Second defamation case for raping E. Jean Carroll

February 8 - The U.S. Supreme Court will hear Colorado ballot arguments of the 14th Amendment (Insurrection)

March 4 - Department of Justice election subversion trial

March 25 - Manhattan hush money trial (Stormy Daniels)

May 20 - Refusing to return Classified Documents in Mar-a-Lago bathrooms case

August 5 - Fulton County, GA election subversion racketeering by 19 people (several have already pleaded guilty)

“Injustice anywhere is a threat to justice everywhere. We are

caught in an inescapable network of mutuality, tied in a single garment

of destiny.”

- Dr. Martin Luther King Jr.

“If you are neutral in situations of injustice, you have chosen

the side of the oppressor. If an elephant has its foot on the tail of a

mouse, and you say that you are neutral, the mouse will not appreciate

your neutrality.” - Archbishop Desmond Tutu

“Justice will not be served until those who are unaffected are as outraged as those who are.” - Benjamin Franklin

“Human progress is neither automatic nor inevitable... Every step

toward the goal of justice requires sacrifice, suffering, and struggle

-- the tireless exertions and passionate concern of dedicated

individuals.” - Dr. Martin Luther King Jr.

Music Association - We Shall Overcome

What Would Be Nice

A Gift

December 22, 2023

Over the next few days, give yourself some time. Give yourself a

moment to play Santa with your life. Think of the ways you have been

naughty and nice. Make two lists or two sketches. Only you can make you

better as a gift for yourself. Make it about you to improve you and

give you a better life.

I wish you would have a moment to put down the electronics and give

yourself some time. Think about how an improved you could have a better

life. Then think about how to get there.

If you don't know how, just consider how much better your life would be

if you were breathing cleaner air, drinking cleaner water, or eating

better food.

And consider asking for help. Consider contacting a mental health professional.

Music Association: The Beatles - Getting Better

What Would Be Nice

Peaceful Protest

November 16, 2023

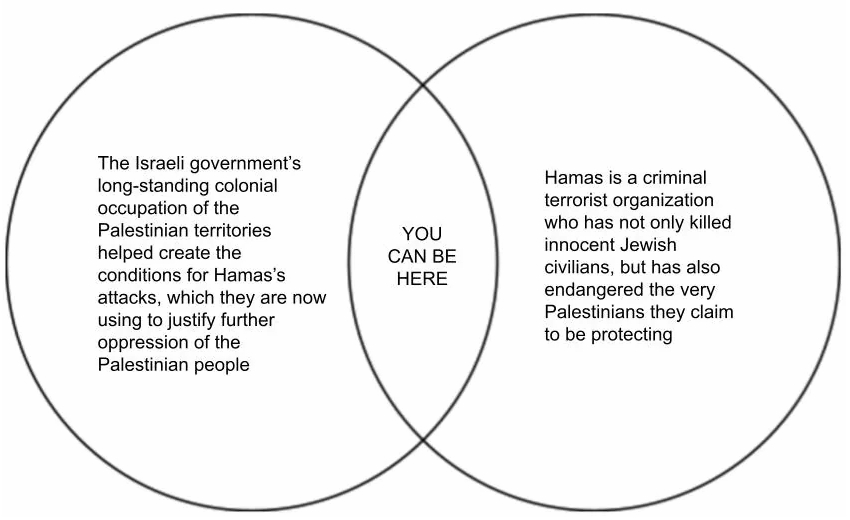

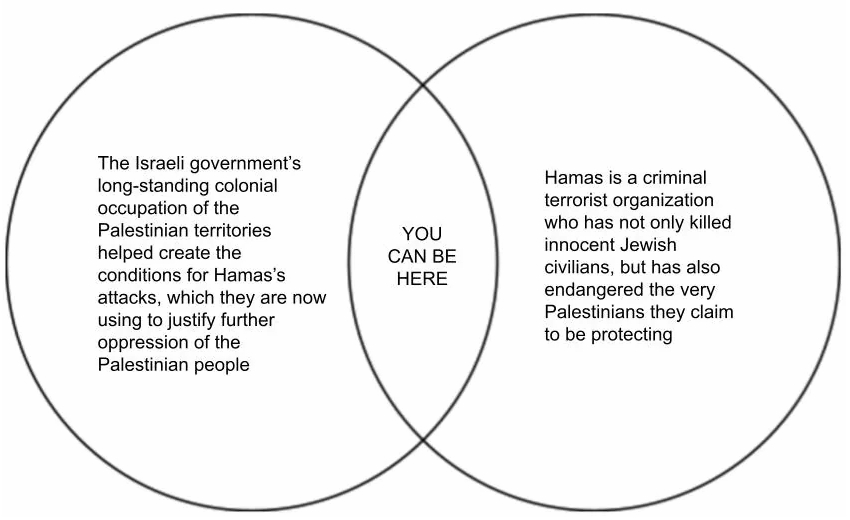

Both Israel and Hamas are wrong in their violence and their tenacious hatred of the other.

Music Association: Bad Company - Bad Company

What Would Be Nice

Cease-Fire

November 5, 2023

Music Association: Diana Ross & the Supremes - Stop! In the Name of Love

What Would Be Nice

Peace in Gaza & Israel

October 30, 2023

Hamas is in Gaza, but Gaza is not all Hamas.

David is Goliath.

Peace, please.

Music Association: John Lennon - Give Peace A Chance

Thousands More

Thousands More

October 14, 2023

Hamas is an extremist group that vows to eradicate Israel.

The covenant of Hamas calls for the genocidal destruction of Israel through an unrestrained and unceasing holy war (jihad).

Hamas attacked the children of Israel last Saturday, killing at least

1,300 people, many of them civilians, wounding thousands, and abducting

more than a hundred. Young people were massacred while attending a musical festival to celebrate peace. Hamas purposefully targeted elementary schools and a youth center. More than 1,799 people in Gaza have been killed in retaliation.

The timing of the attack was meant to disrupt the Israel - Saudi Arabia peace talks,

hosted by the United States with the Saudi benefit of a U.S.-Saudi

defense pact. Saudi Arabia has stopped the negotiations due to the war.

Israel is justified to fight for the release of the hostages.

Yet if Israel commits to a massive ground assault of Gaza, they will be walking into a trap that could kill tens of thousands of Israeli troops.

This is no time to call for peace -- not in Israel, not in Ukraine -- but peace should always be part of the goal.

The people of Israel have my support -- they always have.

Music Association: Paul McCartney - Pipes Of Peace

32 Feet

October 13, 2023

Garfunkel and Simon were walking in the woods. They came to a clearing and saw an abandoned well.

Simon asked, “I wonder how deep that well is?”

Garfunkel said, “We could figure it out.”

Simon asked, “How could we do that?”

Garfunkel said, “We drop something down

it, we time how long it takes to hit the bottom, you multiply that times

32 feet per second squared, the rate at which objects fall in a vacuum,

subtract a little for wind resistance, and we've got the depth of the

well.”

Simon asked, “What are you going to drop down the well?”

Garfunkel stared at Simon. Then looking around, Garfunkel spotted a

large

log lying on the ground. Squatting down with bent legs by the

log, the log was hoisted up. Garfunkel staggered wobbly over to

the edge of the well, tipped the log up, and dropped it down the

well. They started to count, “One hippopotamus, two hippopotamus, three hipp...”

Splash!

Simon said, “Three seconds!'

Garfunkel said, “Quick, multiply that time by 32 feet per second squared!”

“288 feet,” Simon said.

“Subtract a little for wind resistance, let's say 18 feet. The depth of that well is 270 feet deep.”

Simon shouted, “LOOK OUT!” and pushed Garfunkel back while a goat zoomed between them and leaped head first down the well.

Simon said, “What the... I've never seen anything like that.”

Just then a farmer walked up to them and said, “What's going on here?”

Garfunkel said, “We just figured out the

depth of this well to be about 270 feet deep and then the strangest

thing happened. A goat ran between us and jumped head first

down into the well.”

The farmer said, “Thank heaven it wasn't one of my goats.”

Simon asked, “How do you know it wasn't?”

And the farmer said, “Because all of my goats are tethered to big heavy logs.”

Music Association: Simon and Garfunkel - Troubled Water

no actual goats were harmed in the writing of this post

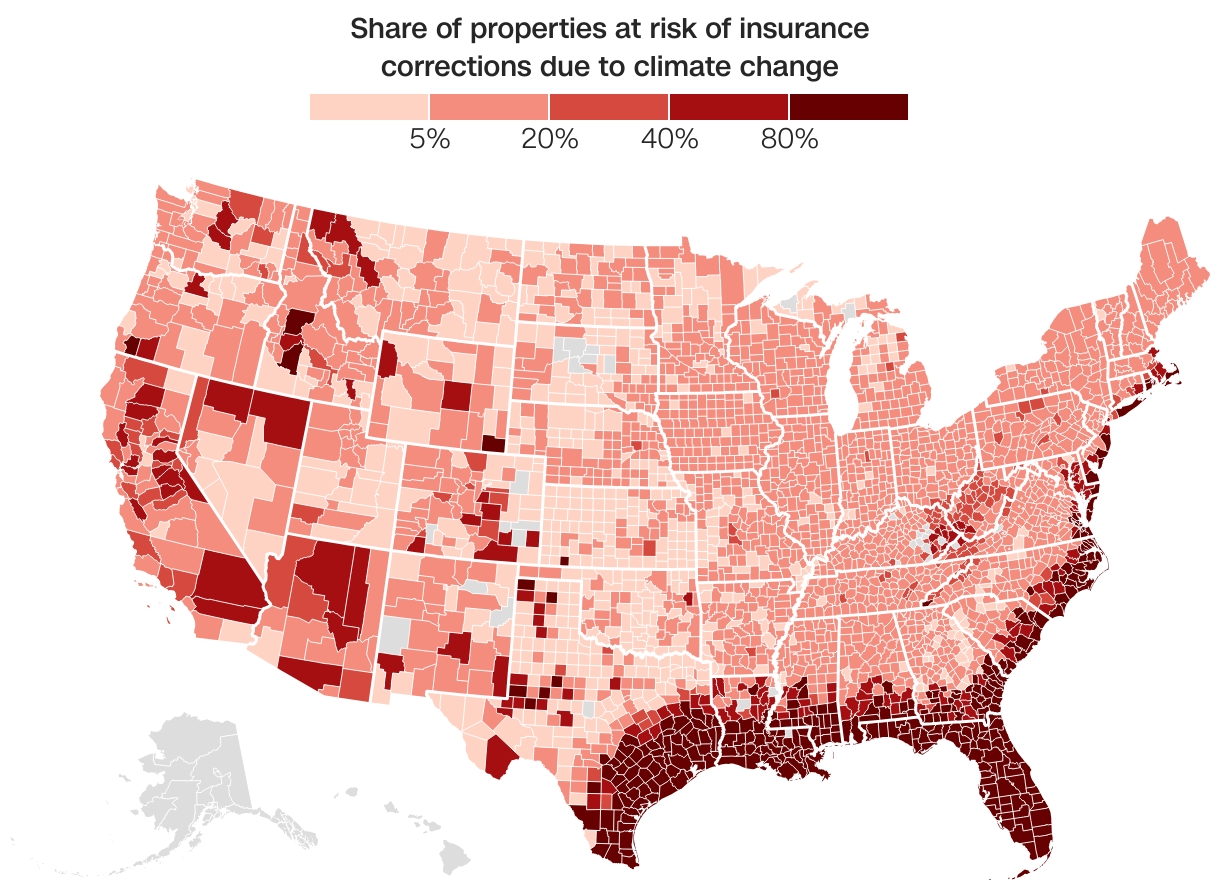

The High Costs of Climate Change

The High Costs of Climate Change

September 24, 2023

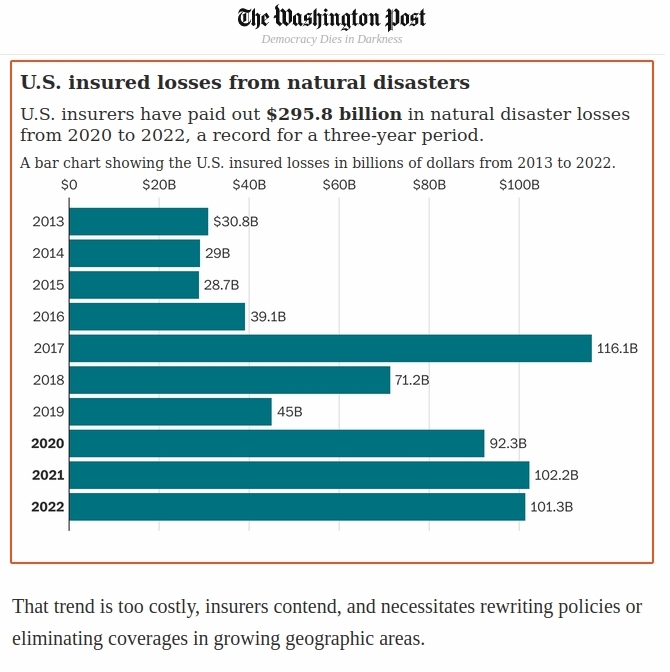

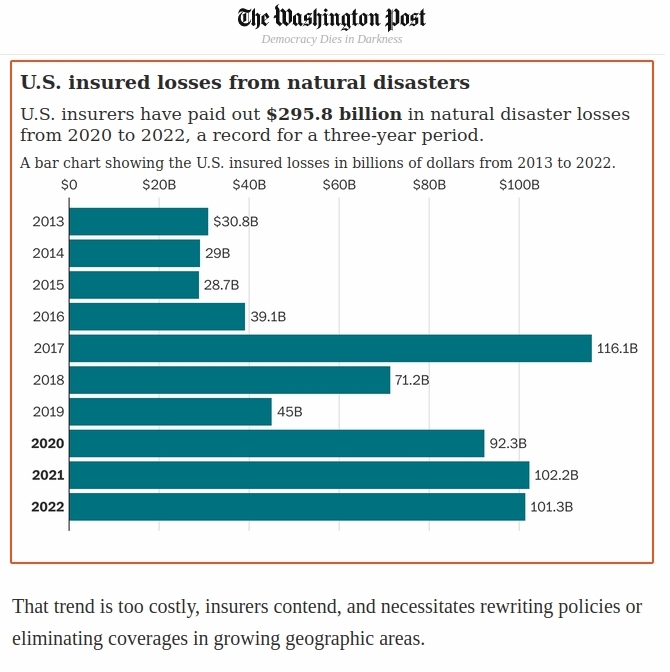

The compounding costs of climate change total trouble for insurance companies... and people too.

AAA, Allstate, American Family, Farmers, Nationwide, State Farm, Erie

Insurance Group, and Berkshire Hathaway have told regulators that

climate change has led them to stop writing coverages in some regions,

exclude protections from various weather events, and raise premiums and

deductibles.

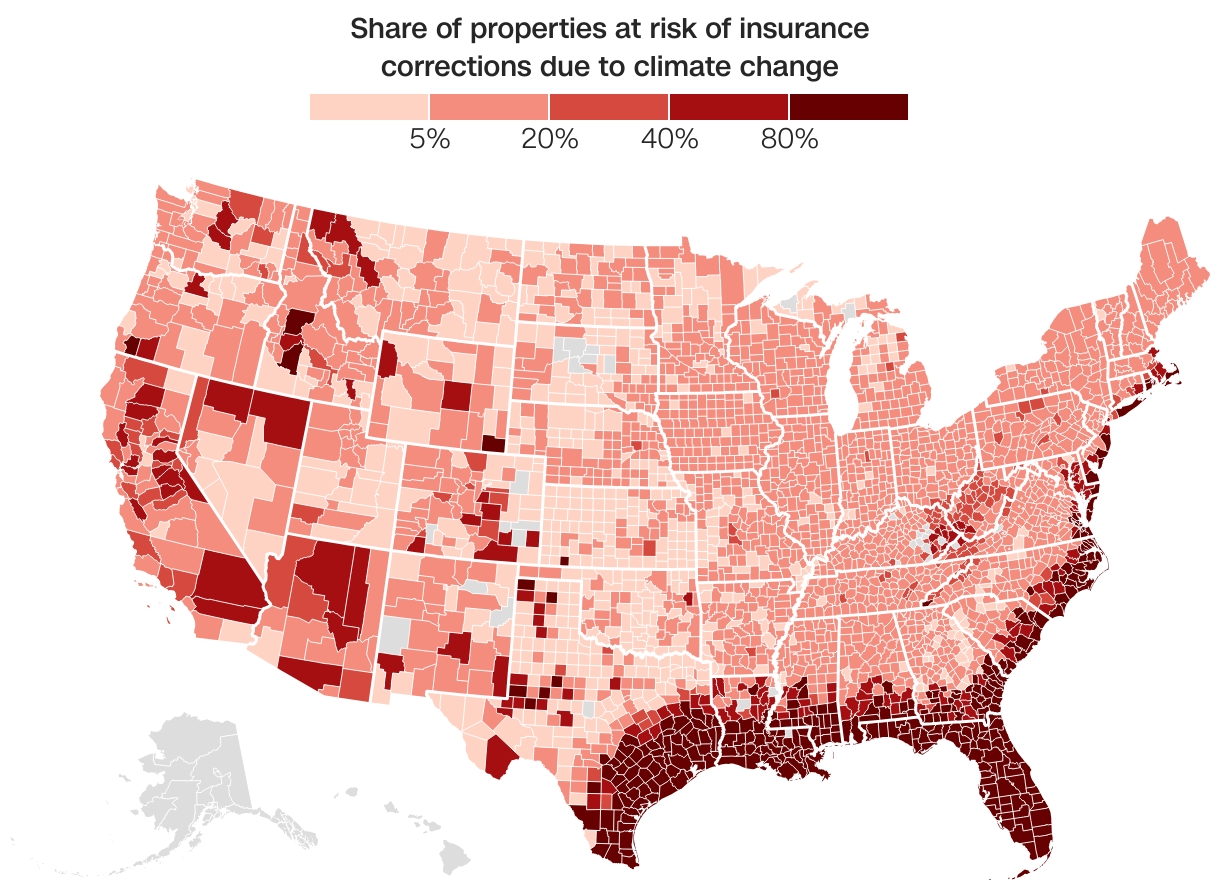

The wildfires in California have been more frequent and intense

because of increased temperatures, droughts, and earlier snow melts.

California has more than 1.2 million homes at moderate to extreme risk

of wildfire damage. Allstate, State Farm, American International Group,

and Chubb have announced they will stop issuing new policies for

California homes. The state is just too risky.

Flood waters and hurricanes continue to swamp Florida. A third of Florida's population lives in flood-prone areas, and even more Floridians are at risk from hurricanes. Home insurance policies in Florida now average $6,000 per year,

more than double the national average of $1,700. Florida home insurance

damage claims are capped at $700,000. And more than 13% of Florida homes are uninsured, about double the national average.

U.S. insurance companies have paid $295.8 billion in natural disaster losses from 2020 to 2022, a record for any three-year period.

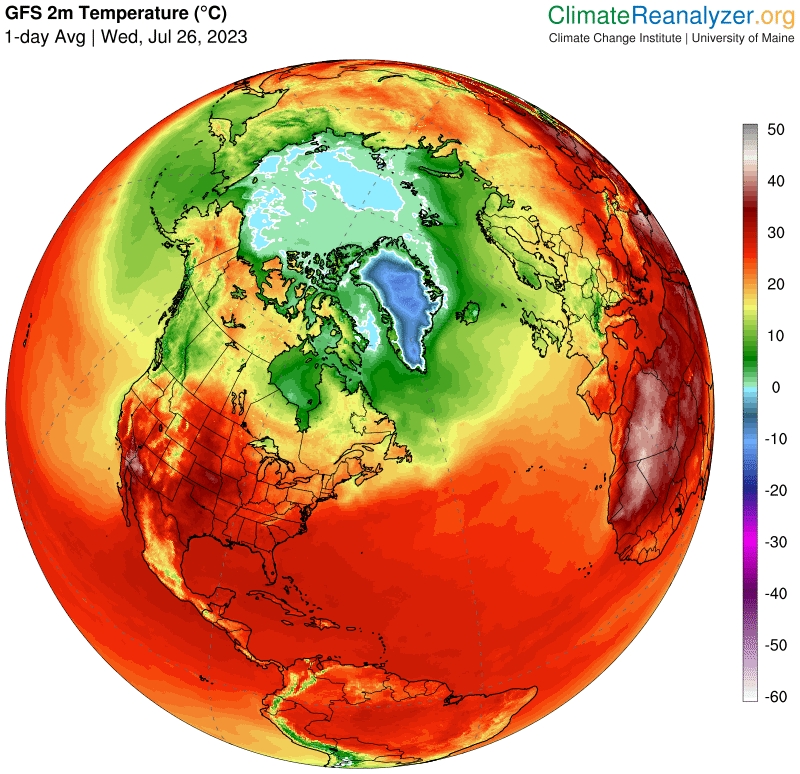

Summer of 2023

This summer had record heat, measured as global and sea surface temperatures.

June of 2023 was the hottest June on record. July was not just the

hottest July but the hottest month since record keeping began in 1880.

The record setting July heat came from equatorial Africa, Alaska,

northern Canada, Mexico, and central America. Phoenix Arizona exceeded

110 degrees for all the days of July. And August of 2023 was the hottest August on record.

The roughly 6,000 Canadian wildfires in 2023 have scorched 34 million

acres (the size of New York state). That's three times larger than any

U.S. fire season and 10 times the 10-year average in Canada. The

Canadian wildfires created 133 pyrocumulonimbus clouds (pyroCbs) with

lightning, great walls of fire, and firenados with heights of 3,000

feet and speeds up to 140 mph. The pyroCbs are associated with volcanic

eruptions and a typical year has 40 to 50 worldwide. Over 150,000

Canadians are currently displaced, with 145 million more in North

America choking on toxic wildfire smoke. And next summer is expected to

be worse.

The deadliest wildfire in modern U.S. history tore through Lahaina Maui

on August 4th, leaving 97 dead and $5.5 billion in property damage.

Is climate change good for anything? Yes, climate change is great for poison ivy.

Music Associations: Michael Murphey - Wildfire

& Jerry Lee Lewis - Great Balls Of Fire

Truth or Consequences

Truth or Consequences

August 26, 2023

“Now. Backstage we have a man that you won't believe. And

before I forget, our hair and makeup department wants you to know they

had nothing to do with his hair and makeup!

“Now. Backstage we have a man that you won't believe. And

before I forget, our hair and makeup department wants you to know they

had nothing to do with his hair and makeup!

“This man had a job. He was fired. He refused to

leave. He called anyone to attack the place. He took important

papers. And now he's trying to get his job back while he's being

prosecuted for attacking his job and stealing papers! The man doesn't have a soul to stand on.

“He thinks he's six foot three. His driver's license says he's six two. His elevator shoes say he's five nine if he's an inch!

“So here's what we're going to do.

“We've talked the people who hang around

him into pulling a little prank on him. Well, we spread around a few

dollars, and everyone was agreeable.

“You're going to love this.

“He's backstage, surrounded by hidden cameras. And we... are going to trick him out of his shoes!”

Music Association: Edd Kalehoff - Come On Down

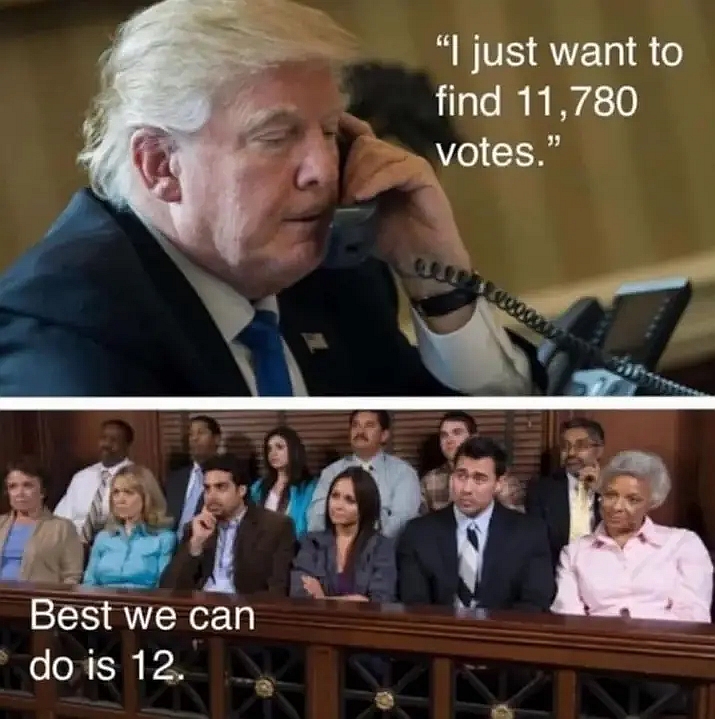

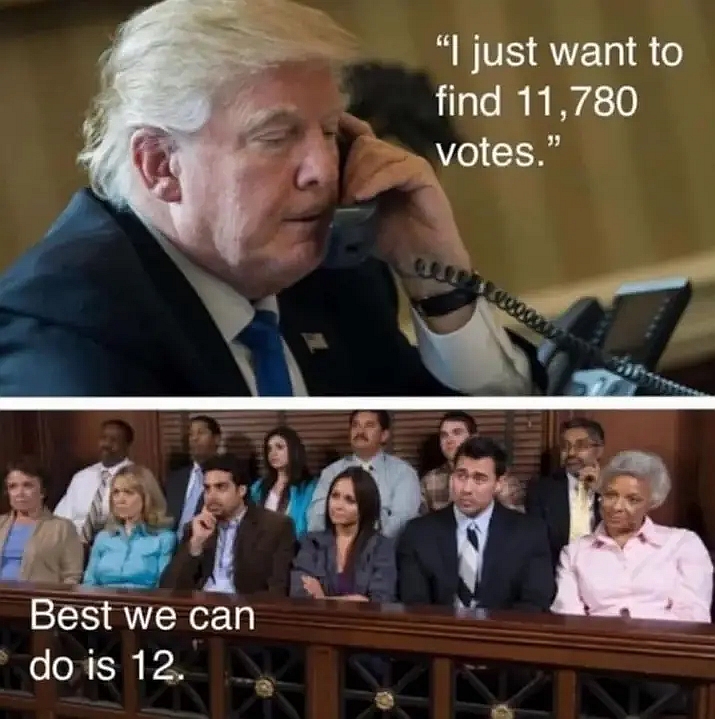

After 2 ½ Years & 75 Witnesses

Georgia Indictment of Trump & 18 Others

After 2 ½ Years & 75 Witnesses

Georgia Indictment of Trump & 18 Others

August 15, 2023

Trump and 18 others were criminally charged in connection

with efforts to overturn his 2020 loss in the state of Georgia,

according to a 41-count, 98-page indictment made public late last night.

Trump was charged with 13 counts, including violating the state’s

racketeering act, soliciting a public officer to violate their oath,

conspiring to impersonate a public officer, conspiring to commit

forgery in the first degree, and conspiring to file false documents.

It’s the fourth and by far the most wide-ranging set of criminal charges Trump has faced.

I. The New York Stormy Daniels hush money case

II. The Mar-a-Lago classified documents case

III. The Justice Department’s investigation into the January 6 attacks

IIII. The Georgia investigation into Trump’s attempts to overturn the 2020 election

Trump currently faces 91 charges in four criminal cases, in four

different jurisdictions (two Federal cases and two state cases). All

plan to try him as an adult.

If convicted in Georgia, Trump could face at least five years in prison

and fines up to $250,000 or three times the amount of any pecuniary

value gained from the scheme to interfere in the election results.

The Georgia indictment has several disadvantages to Trump. It charges

his co-conspirators. It covers many of the post-election plots and

shenanigans to overthrow the United States election. And the Georgia

indictment has nothing to do with Trump appointed judges.

Unlike the Federal cases against Trump's activities, in Georgia the

power to pardon is held by a Board of Pardons and Paroles, which

requires that a sentence be completed at least five years prior to

applying for any pardon.

Plus, Georgia courts are more transparent, more receptive (let's say) to televising Trump's criminal proceedings to the world.

Trump will push to move the indictment from Georgia to the Federal courts.

Music Association: Billie Holiday - They Can't Take That Away

Read the full Georgia indictment - here, here, or here.

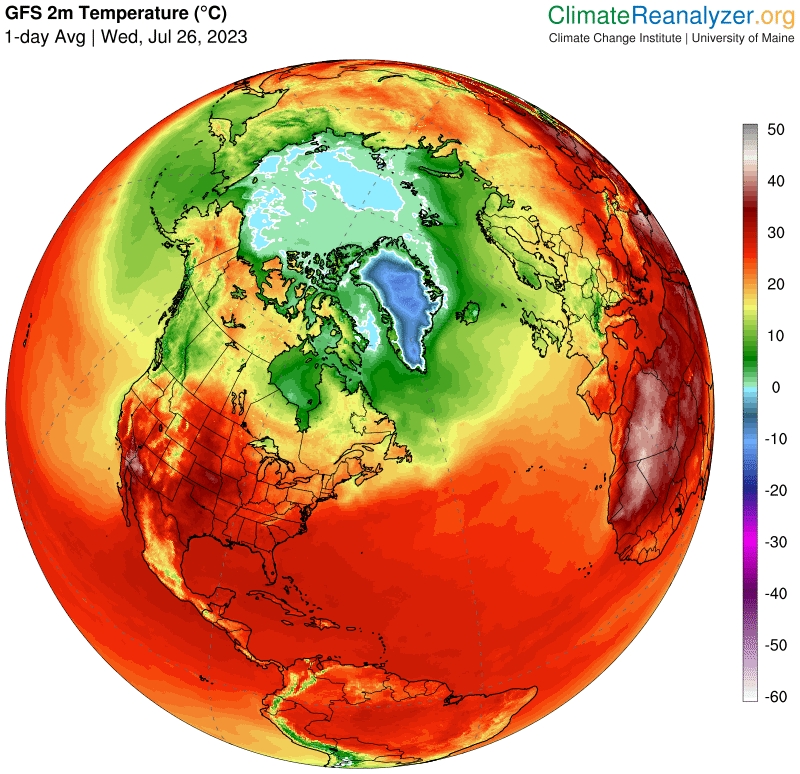

Songs of Sweltering

Record Heat

July 26, 2023

The average planetary temperature hit a record high of 63° F last Thursday, July 20th. Sorry. That's on me. I used the microwave that night to warm up some vegetables.

Anthropogenic climate change caused June 2023 to be Earth’s warmest June on record and is responsible for shattered

temperature records this month in China, Spain, and the southern US.

China set a new national daily temperature record of 126° F

(52.2° C), at the Sanbao weather station in the Xinjiang Uygur

region. Catalonia in Spain recorded its hottest-ever temperature

of 113.7° F (45.4° C).

El Paso has endured 40 consecutive triple-digit days

with at least a few more scorching hot days expected this week, about

twice as long as El Paso's previous record. The streak began June 16.

Phoenix has reached 110 degrees or higher for 25 straight days,

continuing the record for the most days in a row with temperatures that

hot. Phoenix has also had 15 days in a row with lows in the 90s, another

all-time record. The pavement there is more than 40 degrees hotter than the ambient temperature,

hot enough to burn skin. Phoenix Fire Captain Kimberly Ragsdale told

ABC15, “We're seeing people with heat stroke, heat exhaustion,

dehydration, and we are seeing an increase to burn injuries to the

skin.”

At the Las Vegas airport last week, Delta flight 555 sat on the tarmac in 111° F (43.8° C) heat with no air conditioning for four hours.

Multiple passengers were seen by first responders, and a flight

attendant and a passenger were transported to a local hospital.

Someone on social media commented, “Oh, the irony. People sitting on a

plane in the extreme heat that's a direct result of climate change, and

not one person says that maybe, just maybe, the best reason never to

fly Delta (or any airline) is to preserve even a tiny chance of

avoiding catastrophic climate change.”

More than 200 heat-related deaths have been reported in

Mexico. Cattle have also died in Mexico's heat. The heat has also

damaged cotton crops in China and olive crops in Spain. In Europe in

2022, an estimated 60,000 people were killed by the heat.

Sea water hit hot tub level at the tip of Florida. A Manatee Bay buoy recorded 101.1° F

Monday evening, which may be a record sea water temperature, July 24th.

Hot sea water is causing devastating coral bleaching and death in the

supposedly resilient reefs of the Florida Keys.

Record wildfires continue to burn Canada.

More than 650 wildfires were out of control as of July 24th. According

to the Canadian Interagency Forest Fire Center more than 11 million

hectares have already burned in 2023, compared to the 10-year average

of about 800,000 hectares.

And the north Atlantic Ocean Gulf Stream may collapse as soon as 2025,

as part of the Atlantic Meridional Overturning Circulation (Amoc). The

collapse of the currents would have disastrous consequences around

the world, severely disrupting the rains that billions of people depend

on for food in India, South America, and west Africa. It would increase

storms and drop temperatures in Europe, and lead to a rising sea level

on the eastern coast of North America. It would also further endanger

the Amazon rainforest and Antarctic ice sheets. “I think we

should be very worried,” said Peter Ditlevsen, at the

University of Copenhagen in Denmark, and who led the study in the

journal Nature Communications. “This would be a very, very large change. The Amoc has not been shut off for 12,000 years.”

Music Association: Martha & the Vandellas - Heat Wave

Abortion

Abortion

Russia

- Ukraine War

Russia

- Ukraine War

Covid-19

Covid-19

Trump

Timeline (PDF)

Trump

Timeline (PDF)

end

Israeli apartheid

China

in 1989

China

in 1989

George

Floyd

Voter

Suppression

Voter

Suppression

Music

Videos

Music

Videos

Landmine

Hopscotch

Landmine

Hopscotch

Superman

Superman

Impact

Investing

Impact

Investing

Holiday

Gifs of Cats and Kittens Part 1

Part 2

Part

3 Part

4 Part

5

Holiday

Gifs of Cats and Kittens Part 1

Part 2

Part

3 Part

4 Part

5

Southdale

Hennepin Library,

Edina

Library

Southdale

Hennepin Library,

Edina

Library

Wonder

Woman

Wonder

Woman

Food

Fraud

Food

Fraud